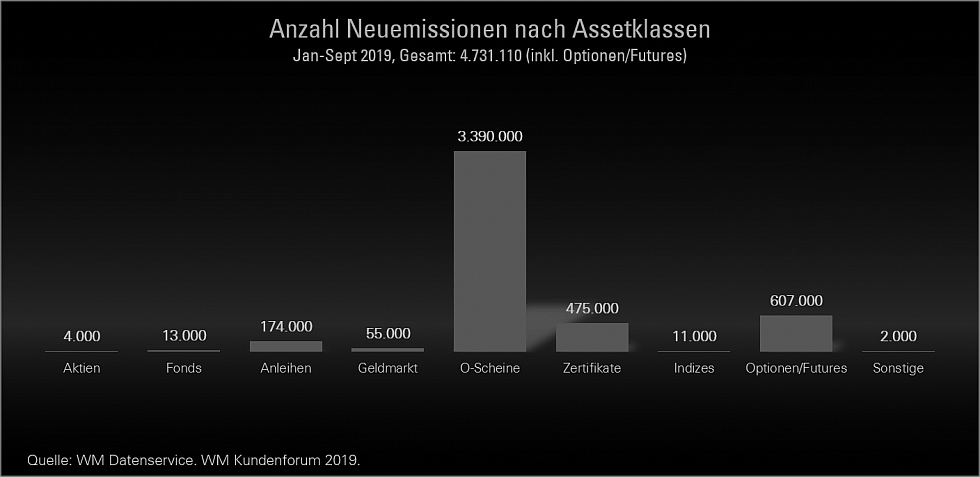

WM Kundenforum: Voraussichtlich 6,3 Mio. Neuemissionen in 2019.

Auf dem Kundenforum des WM Datenservice, vergangenen Donnerstag in Frankfurt, wurden die neuesten Zahlen bekannt gegeben. Demgemäß steigt dieses Jahr die Anzahl der Neuemissionen hochgerechnet voraussichtlich auf rund 6,3 Mio. Gattungen. Ein Zuwachs von 120% innerhalb der letzten fünf Jahre. ...Weiterlesen

Regulatorik schafft Chancen für Fonds-Vermarktung an Institutionelle.

Deutsche Versicherer, Pensionskassen, Versorgungswerke, Unternehmen und Family Offices suchen alle nach attraktiven Anlagen im derzeitigen Niedrigzinsumfeld. Da verwundert es nicht, dass Deutschland der größte Inbound-Markt für alternative und traditionelle Fondsanlagen institutioneller Investoren in der EU ist. ...Weiterlesen

Investment-Steuerreform. Grundlegender Regimewechsel.

Seit dem 1. Januar 2018 ist die Investmentsteuerreform in Kraft. Sie hat das Ziel Systemfehler zu beseitigen, das Verfahren zu vereinfachen und vor allem Gestaltungsmöglichkeiten zu reduzieren. Eine der wichtigsten Änderungen: Das Steuerrecht gilt nun für in- und ausländische Fonds gleichermaßen. ...Weiterlesen

Wertpapiere eindeutig indentifizieren – vor und nach MiFID II.

Ein Wertpapier zu identifizieren ist gar nicht so einfach. Wie identifiziert man ein Wertpapier? Man nimmt einfach die WKN … oder doch nicht? Die WKN (Wertpapierkennnummer), vergeben vom WM Datenservice, sollte eigentlich schon seit vielen Jahren nicht mehr verwendet werden. ...Weiterlesen

Reporting – Fluch oder Segen?

Spätestens nach der Finanzmarktkrise und der darauffolgenden Reaktion der Regulatoren ist Reporting im Sinne von Regulatory Reporting ein furchtauslösender Begriff für viele Finanzinstitute. Die durch Regularien wie MIFID, EMIR und zukünftig MIFID II erforderlichen Meldungen an die Behörden stellen hohe Anforderungen an die zukünftige Reporting-Infrastruktur der Finanzinstitute. ...Weiterlesen

Auf der Suche nach der Wahrheit in Referenzdaten.

Kennen Sie folgendes Dilemma: Wieso kann der Datensatz in Bloomberg sowie in den WM Daten als auch bei der Lagerstelle unterschiedlich und doch richtig, also „wahr“ sein? Gibt es bei Wertpapier-Referenzdaten keine absolute Wahrheit? ...Weiterlesen