INTALUS IS A SPECIALIST IN THE DEVELOPMENT OF FINANCIAL SOFTWARE.

With Grand Central, Intalus offers you the leading solution for managing all data of the WM Datenservice. Among other things, you can enter your own instruments and data fields as well as integrate data from other systems. This makes Grand Central an ideal central reference data management system, designed to meet your needs.

Whenever and wherever you use securities reference data in your business, Grand Central is been a reliable solution for your data management problems. See what our customers think.

Intalus. Made in Germany. Since 1990.

THE GRAND CENTRAL PORTFOLIO.

DATA WAREHOUSE.

Supply connected systems with data and always keep them up to date.

BROWSER.

Provide predefined and individually defined views for data visualization.

EDITOR.

Extend data and create your own instruments, custom fields and spreadsheets.

DATA ON DEMAND.

Interfaces with mappings to Front Arena, Finastra Kondor, Temenos Multifonds, and more.

FRONT ARENA.

Supply Front Arena with the necessary data for new investments and updates.

REPORT SERVICE.

Compile data for internal processes of specific departments or users.

TARGET MARKET.

Customizable target market definition as browser-based view and web service.

EXTENSIONS.

Customer-specific extensions for the perfect management of securities reference data.

NEWS.

GRAND CENTRAL NOW AVAILABLE IN THE CLOUD.

Grand Central, the standard application for managing the securities reference data of WM Datenservice in Frankfurt, is now also available as a SAAS solution. Grand Central Online is securely and scalably hosted on Microsoft Azure, allowing customers to simply log in and get started. The software is hosted on the European infrastructure of Microsoft Azure, ensuring the highest levels of availability, data residency, and compliance. WM Datenservice customers can access their data from the cloud using the Grand Central Browser from any workstation. Optionally, data can be extracted via a web service, for example for reports or further processing in internal systems.

GRAND CENTRAL NOW AVAILABLE IN THE CLOUD.

Grand Central, the standard application for managing the securities reference data of WM Datenservice in Frankfurt, is now also available as a SAAS solution. Grand Central Online is securely and scalably hosted on Microsoft Azure, allowing customers to simply log in and get started. The software is hosted on the European infrastructure of Microsoft Azure, ensuring the highest levels of availability, data residency, and compliance. WM Datenservice customers can access their data from the cloud using the Grand Central Browser from any workstation. Additionally, they can extract data via a web service and process it in their own network.

GRAND CENTRAL SUPPORTS NEW PRODUCT CSR OF WM DATENSERVICE.

CSDs are systemically important as they play a central role in the functioning of securities markets through their securities settlement systems. With the CSDR (Central Securities Depositories Regulation No 909/2014), the European Parliament has created a legal framework for this group of companies. For the resulting demands on the securities business, WM Datenservice, Frankfurt, has announced a new product for 2020: CSR Reference Data; short CSR. Grand Central already supports the new product.

CSR provides the following fields – both in VF1 format and as EDDy XML format:

- GD279A sets the indicator for the main trading venue of a stock in a third country.

- GD279B shows the MIC code for the most liquid market / exchange.

- GV1E1 provides information on the extension period of a deal and the amount of the non-settlement fine. It also indicates if it is possibly an SME growth market.

- Additionally, the fields GD518G, GD209I and XD209A are included.

WM Datenservice has announced that it will deliver the new product from March 9, 2020. Test data will be provided four weeks in advance.

GRAND CENTRAL WEB SERVICE – THE LINK TO WM DATENSERVICE.

The Grand Central Web Service is an interface for client applications to access financial instrument data stored in the Grand Central Data Warehouse (e. g. all data from WM Datenservice), over an Internet or Intranet connection. It provides an easy way to implement financial interfaces without the necessity of writing SQL database queries. LEARN MORE.

FINANCIAL INSTITUTIONS ARE IN TIME NOTICE. FASTER PROCESSING OF INCREASING NUMBER OF SECURITY REFERENCE DATA.

The number of securities master data is increasing rapidly. The time window for (nightly) processing of securities master data and the updating of connected systems is no longer sufficient for many financial institutions. So, the question is: how will a financial institution manage to process a constantly increasing amount of data in a shorter time? LEARN MORE.

TARGET MARKET DEFINITION ACCORDING TO MIFID II IN THE GRAND CENTRAL BROWSER.

To determine target markets – in accordance with the requirements of MiFID II – WM Datenservice offers a comprehensive range of products, such as GAT, MiR and MIR 2 as well as MIR 2C. To ensure that this information does not have to be tedious and time-consuming, Intalus puts it together in the Grand Central Browser. Individually on customer request and for every application, for example as information for the distribution of financial instruments. All data can also be accessed via a web service. LEARN MORE.

NEW IN THE PORTFOLIO: GRAND CENTRAL REPORT SERVICE.

New in the product portfolio: The Grand Central Report Service – The solution for your regulatory reporting. LERN MORE.

WATCHLIST FUNCTION IN THE BROWSER FOR MORE EFFICIENCY.

Rather that always searching and filtering the entire data universe in the Grand Central Browser, individual watchlists can now be created. For example, using ISINs from the dataset of all financial instruments or only WKNs from selected classes of securities. Searching and filtering of the data is thus faster and easier. Watchlists can be easily created by copy & paste. In addition, it can be determined who has the right to create watchlists. LEARN MORE.

GRAND CENTRAL SUPPORTS EDDY. HIGHER DELIVERY FREQUENCY, PRIOR ACCESS.

The amount of WM data is increasing exponentially from year to year. With the full support of WM’s EDDY data stream, Grand Central can help to reduce issues involving data bloat. Data is ordered and delivered in the VF1 format. The advantages are obvious: VF1 data provide additional text fields to uGAT. In addition, the delivery frequency is higher (up to 7 data deliveries daily).

SYNTHETIC FIELDS AS REQUIRED - WITH THE GRAND CENTRAL EDITOR.

With the Grand Central Editor, you extend the scope of your with (fields and values) that are not supplied by the data provider. In addition, new synthetic fields can be created from the values of existing fields according to individual rules. For example, a field that results in a plausibility check in Grand Central or a field with payment dates calculated from interest rates. Furthermore, synthetic fields can be used for values from other data sources – for example, for values from Bloomberg or an SAP system. The advantage is obvious: you can define individual fields and thus further optimize your workflow. All financial instruments can be displayed in the Grand Central Browser – whether the data is supplied by WM, created manually or calculated algorithmically. LEARNMORE.

GRAND CENTRAL SUPPORTS BLOOMBERG. NOW ALSO WITH SFTP DOWNLOAD.

Most of our clients use WM data or processing of financial instruments. Bloomberg reference data (Bloomberg Data License) can be used to extend the data coverage and can be transferred to other systems via interfaces. The order-related data order at Bloomberg, which used to be made via FTP, will now be handled via an encrypted connection (SFTP).

Grand Central is the leading solution for the central management of securities reference data – especially data from WM Datenservice.

Own instruments and data fields as well as data from other systems can be integrated in the Financial Data Warehouse.

Interfaces supply systems such as Front Arena, Finastra Kondor and Temenos Multifonds. Reports replace routine tasks.

FLEXIBLE.

Overwrite data content and set the validity period of the change, e. g. until the data provider provides the correction. Grand Central Editor.

PRECISE.

Convenient search, filter and display options. Personalized queries. Convenient from every workstation. Grand Central Bowser.

EFFICIENT.

Automated delivery of connected systems – complete, inventory-based or user-defined. Grand Central Data on Demand.

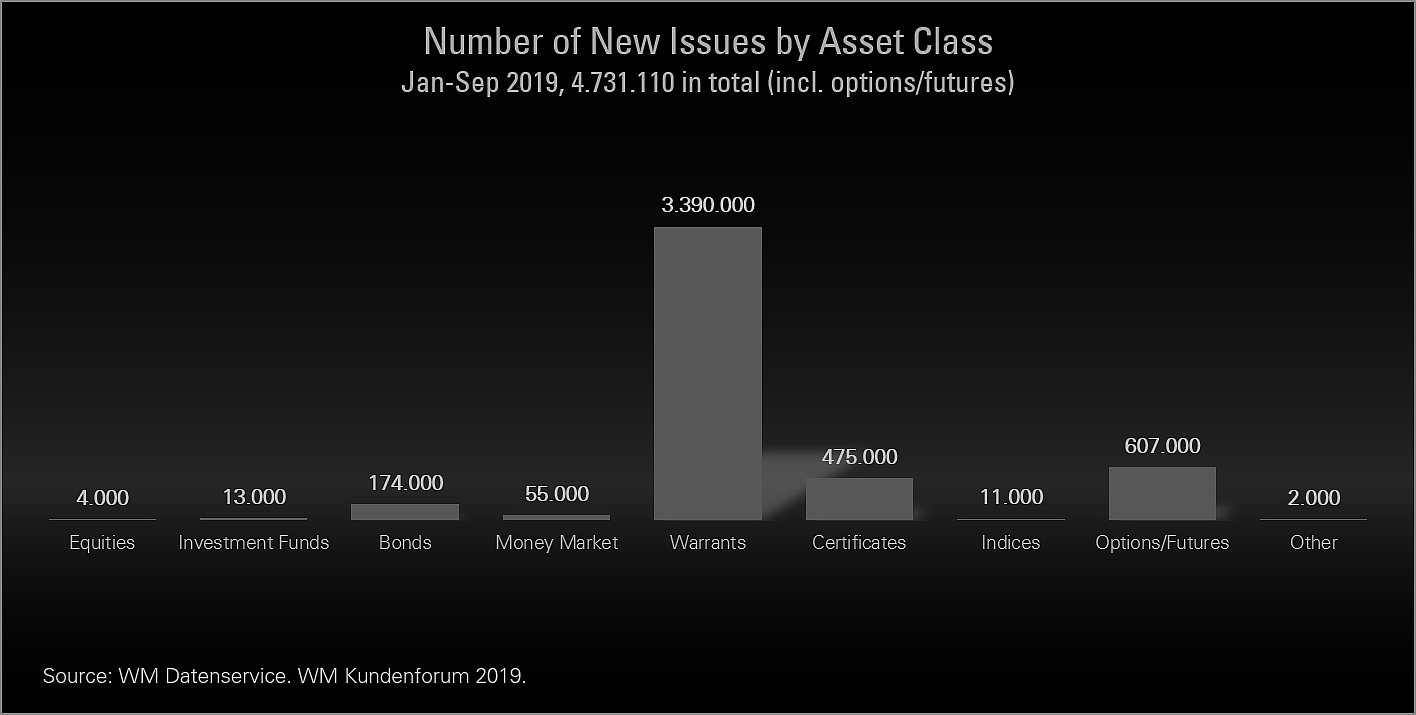

WM customer forum: About 6,3 million new issues expected in 2019.

The latest statistics for WM Data were presented at the WM Datenservice customer forum last Thursday in Frankfurt. According to the presentation, the number of new issues this year will increase to an estimated number of 6.3 million. An increase of 120% in the last five years. ...Read More