EFFICIENT UTILIZATION OF WM MASTER DATA – WITH EXTENSIONS OF GRAND CENTRAL.

WM master data is used in a variety of ways by financial institutions and accounting firms – for example, to make browser-based queries, to monitor changes to data where there are reporting obligations, to calculate derived data fields, or to supply data as an individual VF1 feed for downstream processing systems.

Over time, numerous enhancements have been made to Grand Central, either at customer request, to satisfy new legal requirements, or to increase the efficiency of managing and using master data. Some of these enhancements are described in detail below.

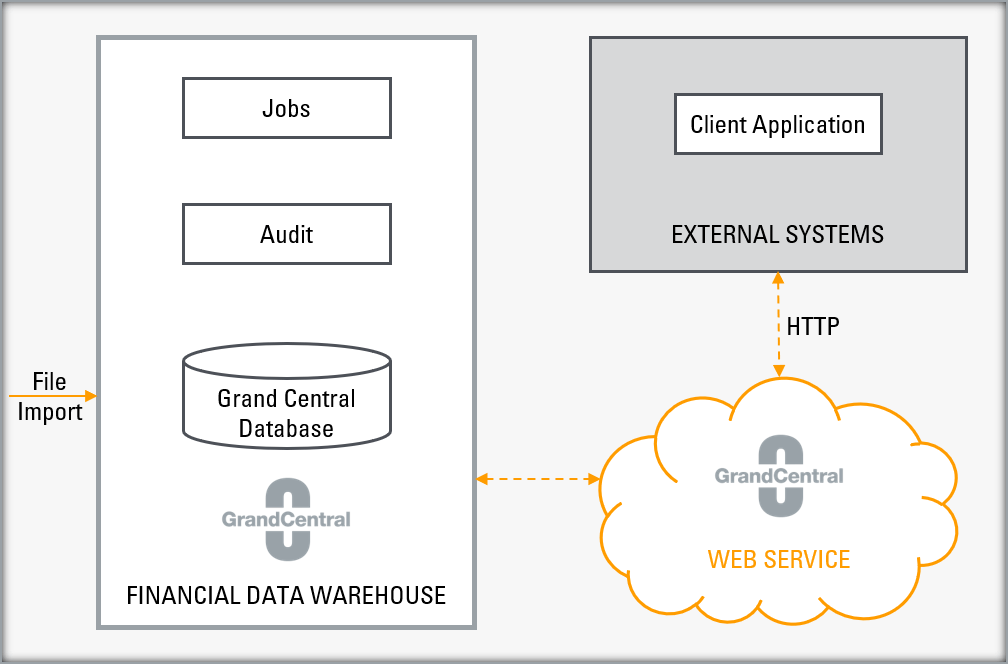

GRAND CENTRAL WEB SERVICE – THE LINK TO WM DATENSERVICE.

The Grand Central Web Service is an interface for client applications to access financial instrument data stored in the Grand Central Data Warehouse (e. g. all data from WM Datenservice), over an Internet or Intranet connection. It provides an easy way to implement financial interfaces without the necessity of writing SQL database queries. READ MORE.

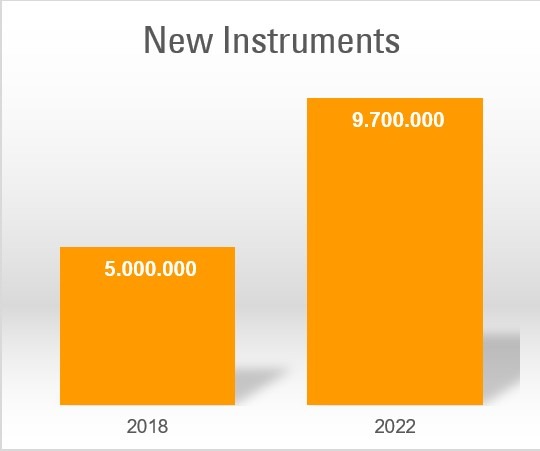

FASTER PROCESSING OF INCREASING NUMBER OF SECURITY REFERENCE DATA.

The number of securities master data is increasing rapidly. The time window for (nightly) processing of securities master data and the updating of connected systems is no longer sufficient for many financial institutions. So, the question is: how will a financial institution manage to process a constantly increasing amount of data in a shorter time? READ MORE.

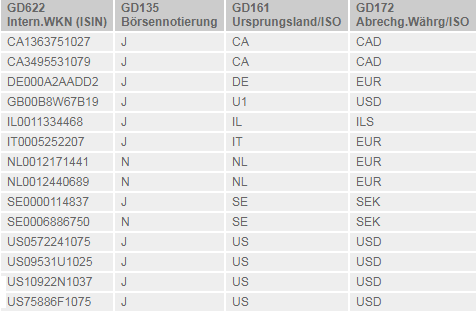

Grand Central supports asset classification reports based on WM master data.

We have recently extended the Grand Central Browser to allow creation of reports about Illiquid Alternative Investments (AIF) for one of the largest law firms. Reports based on WM master data (such as GD fields, income data and fund prices) can be designed and managed in the browser, and the results can be viewed in a browser or exported to Excel for any number of ISINs. READ MORE.

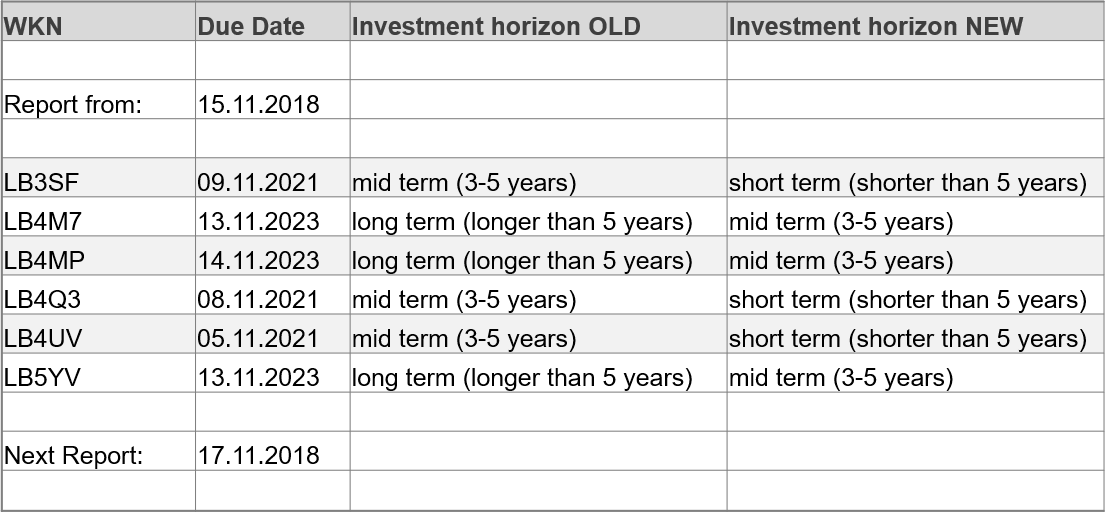

GRAND CENTRAL RECOGNIZES CHANGES IN THE INVESTMENT HORIZON FOR MESSAGES TO THE WM DATENSERVICE.

The client for this individual adaptation of Grand Central is a German Landesbank. Within the scope of the target market classification, the issuer of a financial instrument is required to provide the investment horizon data to WM Datenservice, and to report any changes during the life of the instrument. Grand Central informs the user about changes which need to be reported to WM Datenservice, and controls whether the changes have been implemented by them. READ MORE.

GRAND CENTRAL EXTENSIONS. INQUIRE NOW.

Are you facing new challenges in managing reference data? Contact us.