Regulatory Reporting and Asset Classification using Grand Central.

The German branch of one of the top 10 legal and auditing firms worldwide has commissioned Intalus to development an individual extension of the Grand Central Browser. In addition to advising investment funds on regulatory reporting and tax issues, the company offers a service for classification of illiquid and alternative assets in accordance with the Investment Regulation and Solvency II. For this purpose Grand Central to process the data and formulate reports, together with data provided by WM Datenservice.

Customer Requirements.

To calculate reporting metrics and classify assets, the company uses its own templates in Microsoft Excel. They were looking for a way to fill their templates with the content of arbitrary WM fields for any number of financial instruments (ISINs). In addition, data delivery in the Eddy (Enhanced Data Delivery) format was requested to optimize the resulting costs.

Solution.

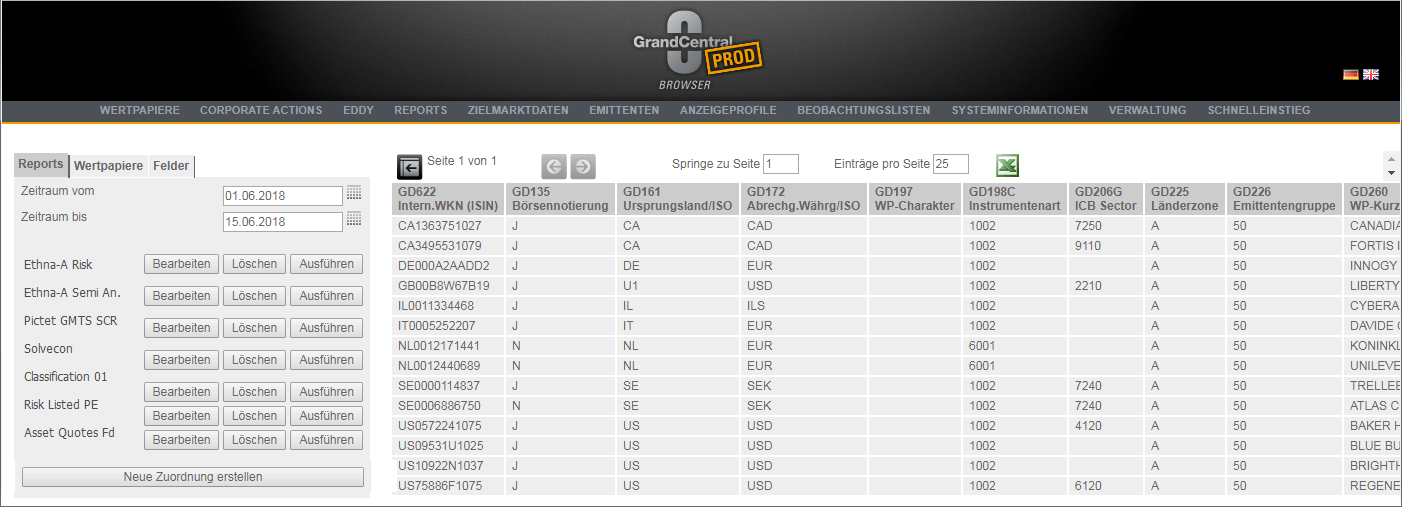

The first task was to develop a frontend allowing lists of ISINs and lists of WM fields to be specified and combined. For this purpose, the Grand Central Browser was extended to include the following new functionality:

- Create and save any securities list, either manually or by importing pre-defined ISIN lists from text files in the Grand Central Browser

- Organize and save WM fields as a list (mainly GD fields, income data and fund prices)

- Create user-defined reports from predefined financial instrument and field lists

- Execute the report and export the results (WM data) in the Microsoft Excel file format

- Order (subscribe) or unsubscribe financial instruments

- Import WM data in Eddy format

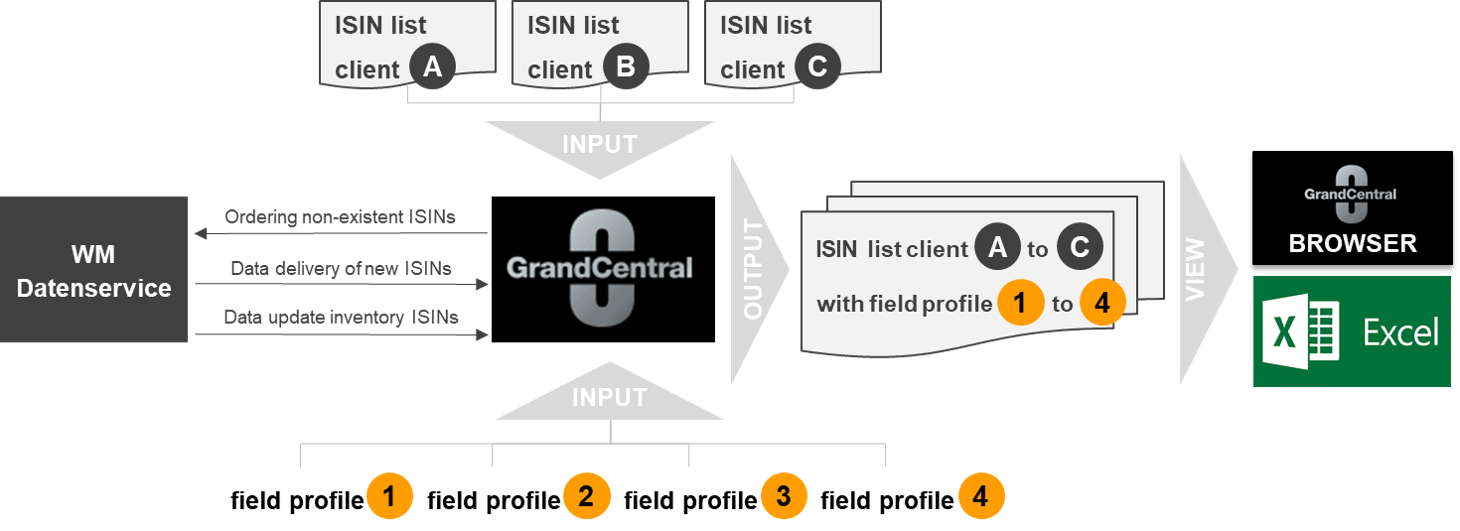

In the course of cooperation with the customer, the original Grand Central Browser has been transformed into a Regulatory Reporting Tool. The following diagram shows how reports are created.

Fig. 2) Schematic representation of Report Generation.

Procedure.

- 01. Clients of the customer provide ISIN lists for evaluation.

- 02. New ISIN data is retrieved from WM Datenservice.

- 03. ISIN Listen werden in GC unter wählbarem Namen gespeichert.

- 04. In GC werden Feldprofile unter wählbarem Namen hinterlegt.

- Ein Feldprofil ist eine ausgewählte Liste von WM Feldern.

- Ggf. ist eine zusätzliche Kennung notwendig, um festzulegen, wie ein Feld dargestellt werden soll, z. B. Tabellenwerte als Schlüssel.

- 05. GC erzeugt Auswertungen aus einer wählbaren Kombination von ISIN Liste und Feldprofil.

- Pro ISIN Liste können auch mehrere Auswertungen mit unterschiedlichen Feldprofilen erzeugt werden.

- 06. Die erzeugten Ergebnisse sind im GC Browser abrufbar und können als Excel Datei gespeichert werden.

- 07. Weitere Features sind möglich, z. B. manuelle Feld-Eingaben oder berechnete Felder.

Summary.

Predefined lists of financial instruments can be created or combined with field lists into custom reports, which can be executed using the corresponding WM data. To optimize data costs, Grand Central monitors how many financial instruments are in the data budget and when they were ordered from WM Datenservice, and when they were last used. Unused financial instruments can be unsubscribed, resulting in reduced costs.

GRAND CENTRAL EXTENSIONS. INQUIRE NOW.

Are you facing new challenges in managing reference data? Contact us.